"Navigating the World of Finance: Expert Insights and Solutions for Your Success"

Navigating the world of personal finances can be overwhelming, at Fleming Fundamental Solutions LLC, we are dedicated to empowering individuals and businesses with comprehensive financial solutions tailored to their unique needs. Specializing in credit repair, life insurance, business credit, tax preparation and planning, as well as bookkeeping and payroll services, we aim to foster financial health and growth for our clients.

Our expert team combines industry knowledge with personalized strategies to help you navigate the complexities of finance. Whether you're looking to improve your credit score, secure life insurance for peace of mind, establish business credit, or ensure accurate tax reporting and bookkeeping, we are here to provide reliable guidance every step of the way. You'll gain the knowledge to converse confidently and make informed decisions.

ABOUT US

Our Years History of Providing Financial Guidance

Our company traces its roots back to 2018 when a group of concerned academics and former finance professionals saw the need for impartial personal finance resources. Too often, financial guidance is provided by institutions trying to market products or push a specific ideology rather than truly equip consumers to confidently manage their money. We launched with the sole mission to offer well-researched, agenda-free curriculum teaching real-life money skills.

With a commitment to integrity and excellence, Fleming Fundamental Solutions LLC strives to build lasting relationships with our clients, ensuring they have the tools and support needed to achieve financial success. Let us help you take control of your financial future today!

OUR SERVICES

Your Journey to Financial Literacy

A transformative program designed to empower clients to take control of their financial futures. This comprehensive guide equips individuals with essential skills and knowledge to navigate the complexities of personal finance confidently.

Our Services

Credit Consulting

Tax Planning/Preparation

Insurance

Bookkeeping/Payroll

Business Solutions

Expert Financial Guidance

Personal Finance E-Books

Business Financial Workshops and Webinars

Financial Coaching and Advising

Why Should You Join Our Financial Learning Program

World-Class Tax Instructors and Preparations

Interactive Business Solutions and Consulting

Insurance and Estate Planning Opportunities

Flexible and Affordable Options: Upskill Now

FAQS

Do I need any prior finance knowledge to benefit from your courses?

We design our personal finance curriculum specifically for beginner to intermediate learners. No matter your starting financial literacy level, our goal is to provide the foundational knowledge to become adept at managing your money. We provide regular updates via email and phone calls, and we also have an online portal where you can track progress on your services. Our team includes certified professionals in financial literacy, credit repair, and tax preparation ready to help you every step of the way.

What is credit repair, and how does it work?

Credit repair involves identifying and disputing inaccuracies on your credit report, improving your credit score over time. This can be done by reviewing your credit report for errors, such as incorrect account information, late payments that were paid on time, or outdated information. Once identified, you can dispute these inaccuracies with credit bureaus. Additionally, responsible credit management, like paying bills on time and reducing debt, contributes to better credit health. Our process includes a comprehensive review of your credit report, identifying inaccurate or outdated information, and disputing these items with the credit bureaus on your behalf. Many clients start seeing improvements within 3 to 6 months, depending on their individual circumstances and credit history.

What types of life insurance do you offer?

We offer term life, whole life, and universal life insurance policies, each designed to meet different financial needs and goals. We work closely with you to understand your financial situation and tailor a policy that fits your needs. Life insurance can serve as a powerful financial tool for building generational wealth by providing a tax-free death benefit to beneficiaries, ensuring financial security for future generations. By leveraging cash value accumulation in permanent life insurance policies, policyholders can access funds for investments, education, or emergencies, enhancing their family's financial stability. Additionally, strategic planning and trust structures can optimize life insurance benefits, allowing families to pass on wealth while minimizing estate taxes and maximizing the legacy left for heirs.

What bookkeeping/payroll services do you provide?

Our services include accounts payable and receivable management, bank reconciliations, financial statement preparation, and payroll processing. Using bookkeeping and payroll systems helps ensure accurate financial records, which are essential for making informed business decisions. By streamlining payroll processes, businesses can improve employee satisfaction and retention, ultimately leading to enhanced productivity. Additionally, effective bookkeeping provides insights into cash flow and expenses, allowing for better budget management and financial planning

Do you offer tax planning and preparation services?

Yes, we provide comprehensive tax planning throughout the year to help you maximize deductions and minimize tax liabilities. Tax planning and preparation are crucial for optimizing tax liabilities, ensuring that businesses take advantage of available deductions and credits. Furthermore, thorough tax preparation minimizes the risk of audits and penalties, providing peace of mind and allowing business owners to focus on their core operations. We offer audit support, including assistance with gathering documentation and representing you in front of the IRS if needed.

How can I establish business credit and what funding options do you help clients access?

We assist clients in securing various funding options including business loans, lines of credit, and vendor credit accounts. We guide you through registering your business, obtaining an Employer Identification Number (EIN), and using trade lines to build your credit profile. Securing appropriate business funding is vital for growth, allowing companies to invest in new projects, expand operations, and improve cash flow. Additionally, establishing a strong funding strategy can enhance credibility with investors and lenders, making it easier to access financial resources when needed.

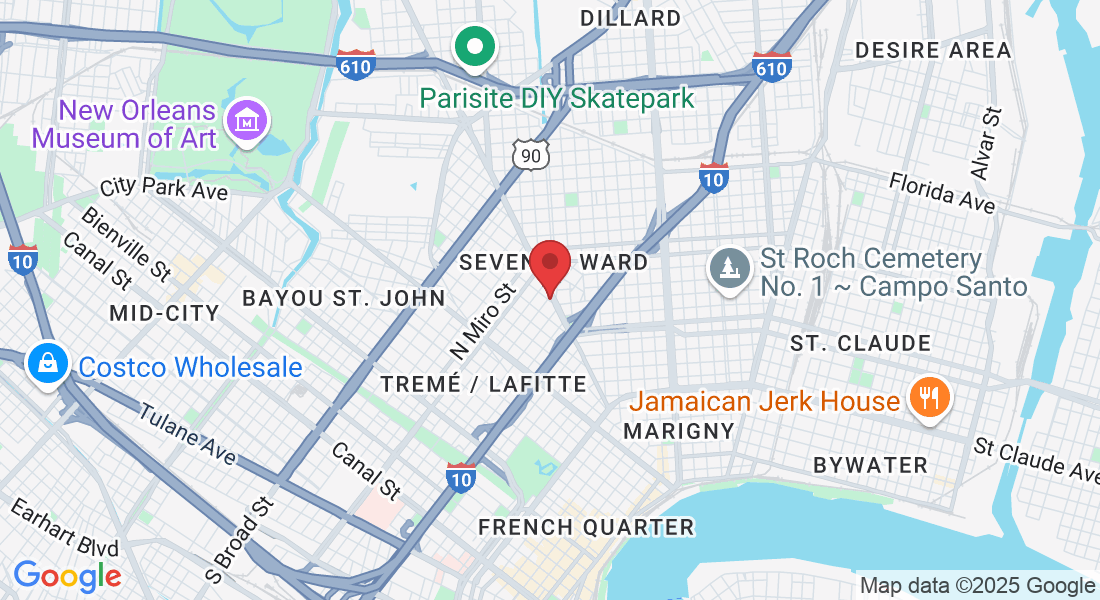

Fleming Fundamental Solutions

Address: 1836 St. Bernard Ave, New Orleans, LA, 70116

Phone Number: (504) 641-3101

Email: [email protected]

Assistance Hours :

Mon – Sat 9:00am-5:00pm

Sunday – Closed